65% of employees globally say money is their biggest stress.

73% would happily switch jobs for better financial wellness.

8% of employers in India offer financial wellness programs — that’s too few.

Financial Wellness, Built for Your Team

Our program combines expert guidance, digital tools, comprehensive education, and community support to help employees achieve their financial goals. From Freshers to Senior-most Management, we’ve got everyone covered.

DOWNLOAD OUR CORPORATE BROCHURE Download Learning Tracks

WHAT WE TEACH

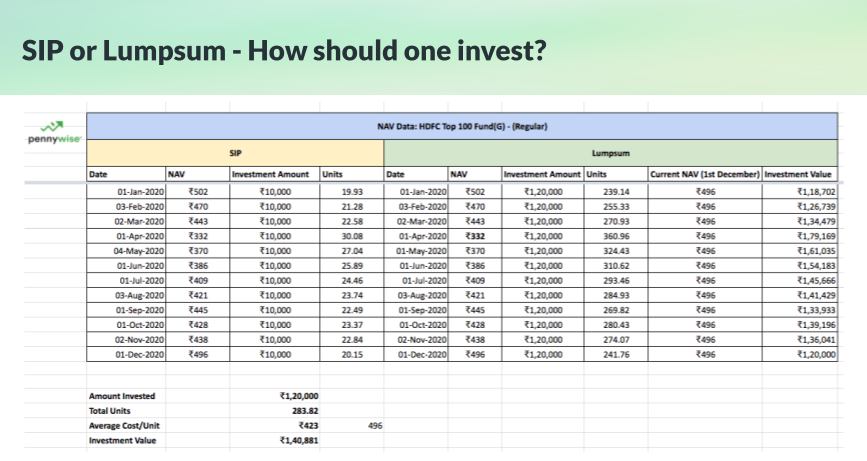

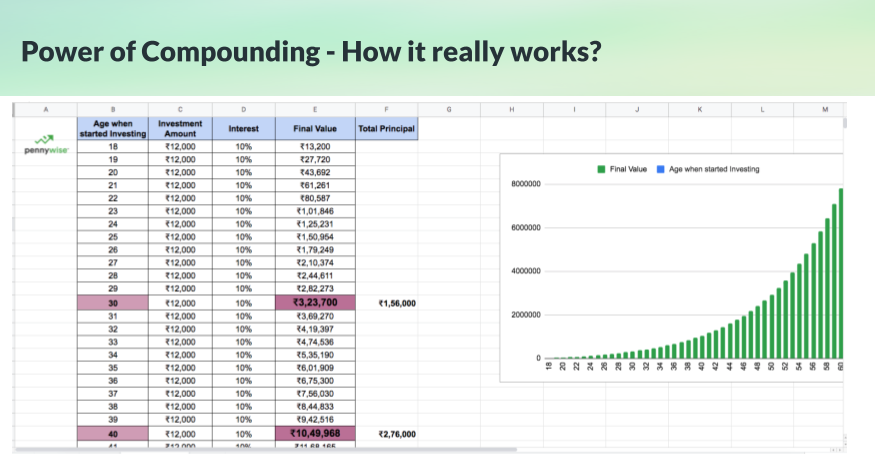

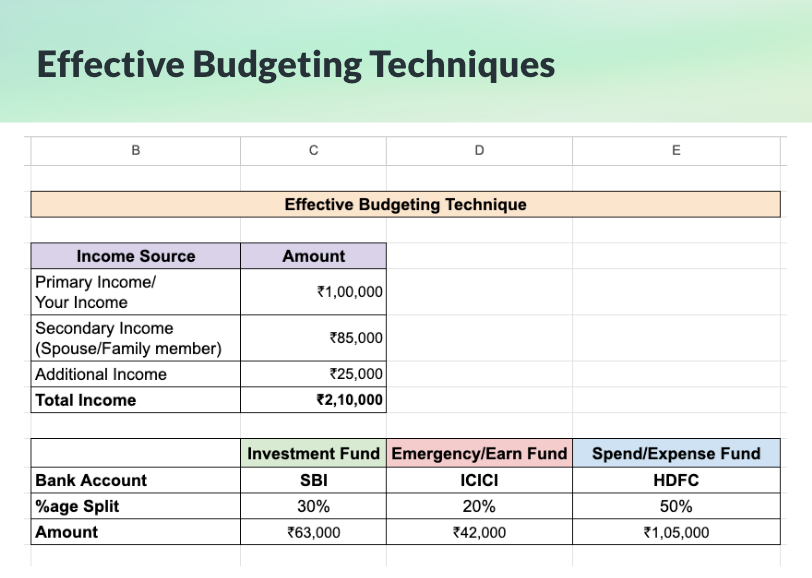

The Basics – Why save & Invest, What’s Inflation, Effective budgeting strategy

An Overview of all financial avenues –

Equity, Debt, Gold, Real Estate

Assets & Liabilities, Calculating your Net Worth

Fixed Income Instruments – NHAI, InVits, REITs, Debt Instruments

Effective Tax

Planning and Filing

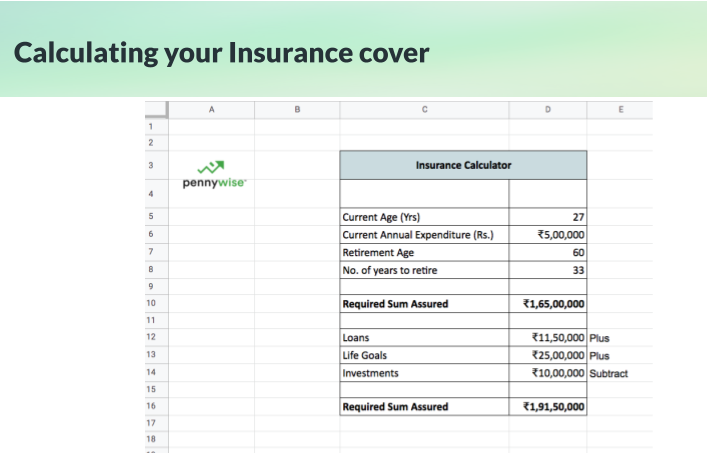

All about Insurances: Life, Health & Other important Must Have Insurances

Fundamentals of Direct Equity investment, Stock Selection

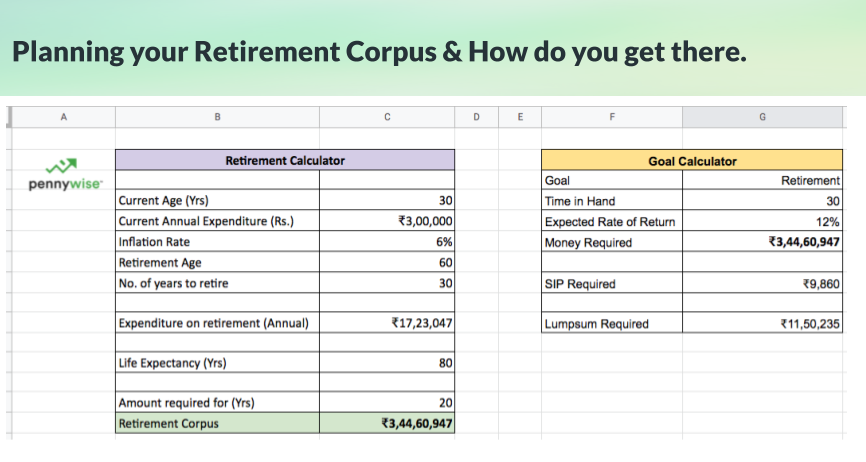

Retirement Planning, Optimising & Reducing your BAD DEBT

Financial Hacks, Tips,

Tools & Tricks

And Many more…

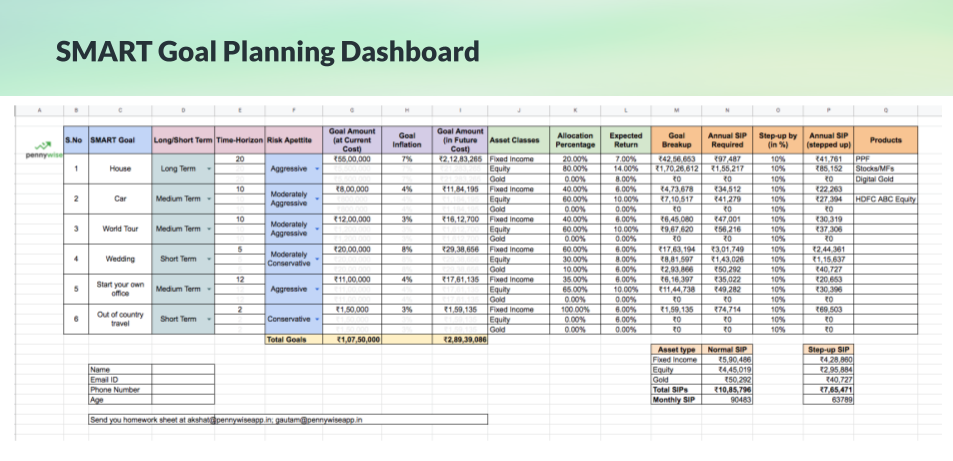

Our workshops are supported with 50+ Trackers (Across topics), Access to additional videos and reading material through LMS and lifetime Community support.

Our Approach to Financial Wellness

Step 1: Knowing Your Team

We tailor a program that fits your employees’ needs—with digital tools, structured learning, and engaging content.

Step 2: Driving Engagement

Interactive sessions, expert-led insights, and one-on-one guidance to empower employees to take control of their finances.

Step 3: Setting Financial Goals

From short-term budgeting to long-term wealth building, we provide evolving solutions and ongoing support for lasting financial well-being.

Benefits

For Employees

Strong grasp of personal finance concepts.

Smarter saving, investing, and budgeting.

Confident, goal-based financial decisions.

Better debt management and wealth growth.

Easy-to-use digital tools for planning & tracking.

Greater financial well-being and security.

For Organizations

Higher employee satisfaction and well-being.

Increased focus and productivity at work.

Better retention and workplace engagement.

Reduced financial stress, boosting performance.

Stronger trust through employee-first policies.

A financially stable and resilient workforce.

What Makes Us Different?

Mission-Driven Educators

We spread PURE financial literacy—no product sales, no bias. Just knowledge that empowers.

Learn & Take Action

10+ hours of insightful content + easy-to-use Excel trackers for REAL financial progress.

Your Financial Support System

Lifetime FREE access to the Pennywise Community—guiding you today, tomorrow, always.